“Have you ever wondered why Bitcoin was created? Was it simply a project by a coder with a financial background, or is there something darker?”

Introduction:

For as long as I can remember, I’ve believed that the world’s most powerful individuals — the top 1% — are guiding humanity toward a predetermined goal. This goal is the establishment of a new world order, where society is meticulously controlled and governed. This belief is often dismissed as conspiracy theory, but parallels can be found in popular media, such as the TV show Mr. Robot, which offers a chilling depiction of such a scenario. If you haven’t watched it yet, I strongly recommend it.

The Origins of a Global Conspiracy:

The roots of this theory trace back to 1990 when Germany sold Crypto AG, a company specializing in encryption technology, to the CIA. Crypto AG was pivotal in developing secure communication lines and encryption tools, which were used by over 120 countries. However, the nations using this technology were unaware that they were being spied on by the very creators of their security systems — the United States and Germany. This massive surveillance operation was not just a matter of intelligence gathering; it was a lucrative business, with the information obtained being sold on the black market. This operation only stopped in 2018, coinciding with what became known as the “Great Crypto Crash.”

Around the same time that the CIA acquired Crypto AG, another significant development occurred within the U.S. intelligence community. In 1996, the NSA published a whitepaper titled, “How to Make a Mint: The Cryptography of Electronic Cash.” This document outlined the fundamental principles of blockchain technology and the creation of electronic cash — a concept that would later be realized as Bitcoin. The paper provides a blueprint for creating a digital currency system remarkably similar to what Bitcoin would become. But this was not the end of the NSA’s involvement.

You can view the full whitepaper here.

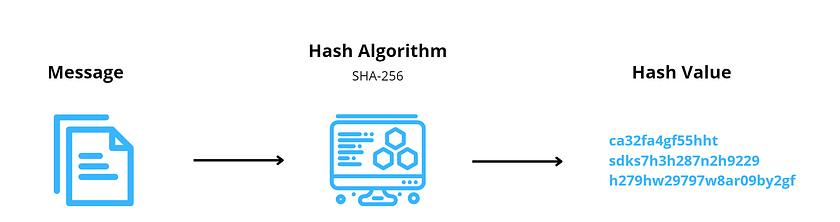

In 2001, another critical document was leaked: “The NSA’s Creation of the SHA-256 Cryptographic Hash Function.” This function is a key element in modern encryption, transforming data into a secure format that is unreadable without the correct key. What makes this significant is that SHA-256 is the cryptographic system used by Bitcoin to secure its transactions. This raises an intriguing question: Was the NSA laying the groundwork for a digital currency revolution long before Bitcoin’s official creation?

The Creation of Bitcoin:

By 2005, the NSA had all the code it needed to create a cryptocurrency. However, it lacked a platform and a name. Around this time, leaks revealed that the NSA and the Pentagon were investing heavily in supercomputers and expansive data facilities in Utah and Maryland. The Utah data center, in particular, is said to have around 100,000 square feet dedicated to computers, drawing more than 60 megawatts (MW) of power. This is more than sufficient to support a blockchain network like Bitcoin. As for the name, the pseudonym “Satoshi Nakamoto” was chosen.

In 2008, an individual or group using the name Satoshi Nakamoto published “Bitcoin: A Peer-to-Peer Electronic Cash System.” This paper outlined a decentralized digital currency based on blockchain technology, designed to operate without a central authority. The timing of this publication is notable — it came just as the world was reeling from the 2008 financial crisis, a period of significant instability and uncertainty. In January 2009, Bitcoin was officially launched, marking the beginning of what many saw as a revolutionary new financial system.

Yet, despite Bitcoin’s global impact, the true identity of Satoshi Nakamoto remains a mystery. Some have speculated that Dorian Satoshi Nakamoto, a man living in California, is the creator, but this theory has been largely debunked. The name itself is intriguing: in Japanese, “Satoshi” can mean “source of wisdom” or “intelligence,” while “Nakamoto” can translate to “central” or “origin.” Could this be a subtle reference to “Central Intelligence,” hinting at the involvement of a government agency like the CIA or NSA?

Bitcoin’s Role in Global Control:

Since its inception, Bitcoin has been involved in a series of significant global events that suggest a deeper agenda at play. In 2013, it was revealed that the NSA was monitoring Bitcoin users. This information, brought to light by whistle-blower Edward Snowden and a Freedom of Information Act (FOIA) request, showed that the NSA was using its XKeyscore software to track Bitcoin enthusiasts. This software is capable of pinpointing a user’s Internet Protocol (IP) address, providing the agency with the ability to monitor and potentially control those involved in the cryptocurrency market.

Bitcoin has also played a crucial role during times of financial crisis. In 2015, during Greece’s financial meltdown, many citizens turned to Bitcoin to safeguard their savings and conduct transactions outside the control of traditional banks. This scenario has been repeated in countries like Venezuela, Zimbabwe, Argentina, Lebanon, and Nigeria, where local currencies have plummeted in value, making them almost worthless. In these situations, cryptocurrencies have become a lifeline, allowing people to participate in the economy when their national currencies have failed them.

These instances highlight a critical point: Bitcoin, and by extension, blockchain technology, has been tested on a global scale, and it works. The current global financial system is debt-based, with the U.S. dollar serving as the world’s reserve currency. However, the dollar’s value is dangerously inflated, making it a ticking time bomb waiting to explode. When this happens, the world will need an alternative, and Bitcoin could be that solution.

But Bitcoin, as we know it, is just the beginning. The real game-changer could be the introduction of Central Bank Digital Currencies (CBDCs). These digital currencies will not simply replicate traditional fiat money; instead, they will be issued directly by central banks, allowing these institutions to control every transaction, impose limits, and create detailed financial profiles of individuals. This level of control is unprecedented and could lead to a society where every aspect of an individual’s financial life is monitored and regulated.

Christine Lagarde, President of the European Central Bank, has already hinted at this future. In a recent discussion, she mentioned that the Digital Euro will likely be programmable, with restrictions on purchases above certain amounts. Currently, cash transactions above 1,000 euros are banned in many European countries, with penalties including fines and imprisonment for violations. The Digital Euro could take this a step further, allowing central banks to control not just the amount of money people can spend but also what they can spend it on.

You can watch Christine Lagarde discussing these restrictions here.

The Road Ahead:

So where could all of this lead us? As we delve deeper into this theory, the implications become increasingly alarming. The overarching goal appears to be the establishment of a final stage of societal control, where governments can address problems more efficiently, maintain tighter control over the population, and create a seemingly perfect economy. A cryptocurrency like Bitcoin could be integral to achieving this vision, with speculation suggesting that a global digital currency might be fully implemented by 2030.

Former Goldman Sachs executive Raoul Pal has gone on record suggesting that Bitcoin’s pseudonymous founder might have been a group of government employees from the U.S. National Security Agency (NSA) and the UK’s Government Communications Headquarters (GCHQ). According to Pal, these individuals were likely tasked with experimenting with solutions to future threats to the West’s international monetary dominance. He pointed out that Bitcoin’s emergence during the 2008 financial crisis might not be a coincidence, stating:

“I don’t think it’s a coincidence it came out in the (2008) financial crisis. I don’t think it’s a coincidence that the halving cycle and all of this [are] related. It is the solution, always has been the solution. You just can’t go there tomorrow.”

To facilitate this transition, governments might employ a series of calculated strategies to drive widespread adoption of the new digital asset. This could involve creating ongoing financial instability through continuous market crashes, hyperinflation, or deflation, thus making traditional financial systems appear increasingly unreliable. As people lose faith in established systems, they may be more inclined to embrace the new cryptocurrency as a stable alternative.

The approach could mirror the methods used to promote COVID-19 vaccinations, where access to certain services and establishments was restricted without proof of vaccination. In a similar vein, the adoption of the new digital currency might be encouraged through gradual, indirect enforcement. Non-government cryptocurrencies could be increasingly outlawed and portrayed as dangerous or criminal, further consolidating users into the government-sanctioned currency.

The final phase could involve the integration of advanced biometric technology, such as a biometric chip that processes all transactions and provides authorities with comprehensive financial profiles. This would not only streamline transactions but also grant unprecedented control over personal finances. Those who refuse to adopt the new currency or technology might find themselves marginalized, unable to access essential services or fully participate in the economy.

In this potential future, the top 1% would wield a vast network of data, effectively establishing a new world order where the final stage of societal control is achieved. This vision may seem like science fiction, but the increasing centralization of financial systems and advancements in technology suggest that we should remain vigilant.

Leave a Reply