“Find out how Coinlegs and Hyblock can provide you with valuable resources and strategies for successful trading.”

In the ever-evolving world of cryptocurrency, finding the right tools and resources can be a game changer. While popular platforms like Binance and Coinbase are well-known, there are lesser-known sites that can give you a significant edge in your trading journey.

Coinlegs

Coinlegs is a powerful yet under-the-radar platform that offers advanced trading tools (Supply/Demand, ATH/ATL, RSI, Volume Spikes) and comprehensive market analysis (CCI, Ichimoku, MACD, Stochastic, Trend Reversal and Others…). It provides traders with real-time data on cryptocurrency prices, charts, and trends, allowing users to identify profitable trading opportunities. With its user-friendly interface and a wealth of resources, Coinlegs empowers both novice and experienced traders to make strategic moves in the crypto market.

Strategy Example:

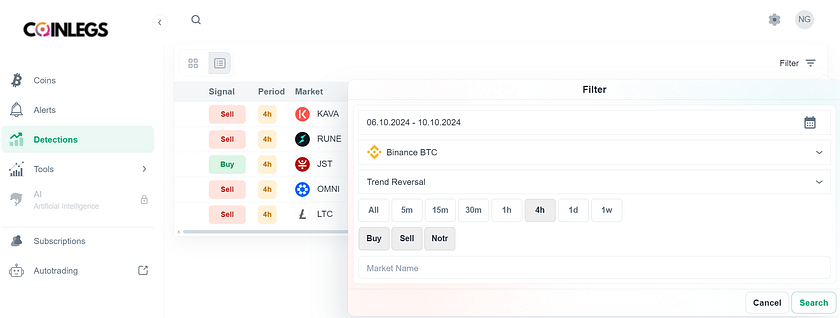

A straightforward strategy you can implement is the “Trend Reversal Detection.” I also find the “RSI Overbought Detection” effective. To set up your strategy, navigate to the Detections Section on the homepage, then open the filter menu to select your configurations.

Select the date you wish to analyze. Remember, a larger time gap between dates provides more information, but it also increases the risk due to the duration since the signal was generated. If you’re trading futures on Binance, make sure to select “Binance Futures.” Next, choose the “Trend Reversal” option and the time frame you want to analyse.

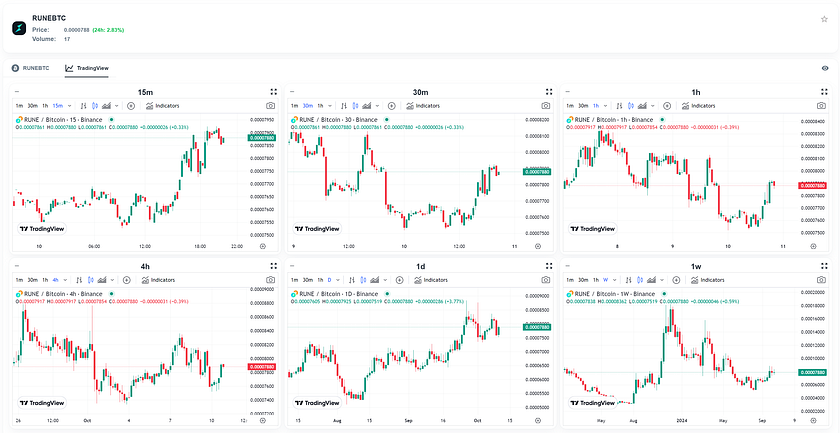

After analyzing the results, RUNE generated a sell signal on the 4 hours chart, resulting in a maximum price decrease of 0.99% within 26 minutes of the signal detection. Following this analysis, you can open TradingView chart corresponding to the 4h time frame to further evaluate the signal and determine whether you want to proceed with the sale.

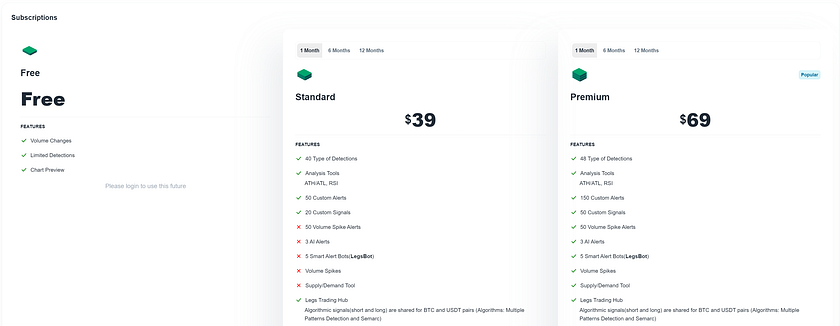

Subscriptions:

HyblockCapital

HyblockCapital is a comprehensive platform offering real-time trading metrics and advanced tools for cryptocurrency traders. With over 100 indicators, it provides insights into order flow, order book, open interest, and long-short data, as well as advanced features like TradingView charts, heatmaps, and liquidation levels. For advanced users and institutions, Hyblock offers API access to real-time and historical data, enabling seamless integration with custom systems.

Strategy Example:

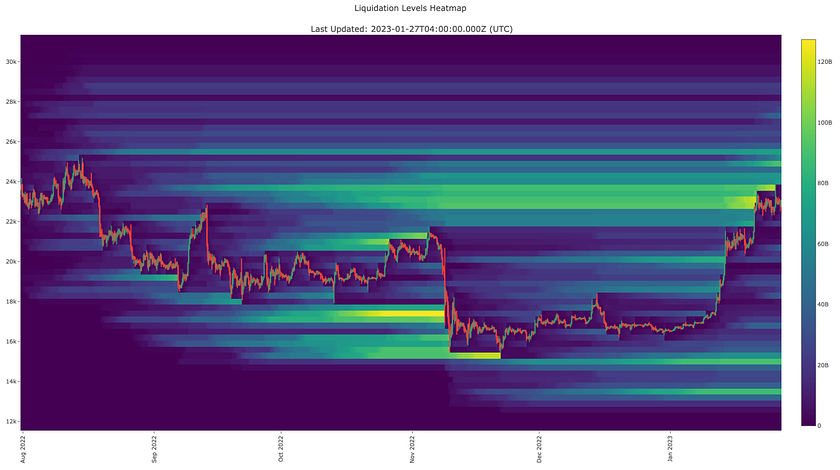

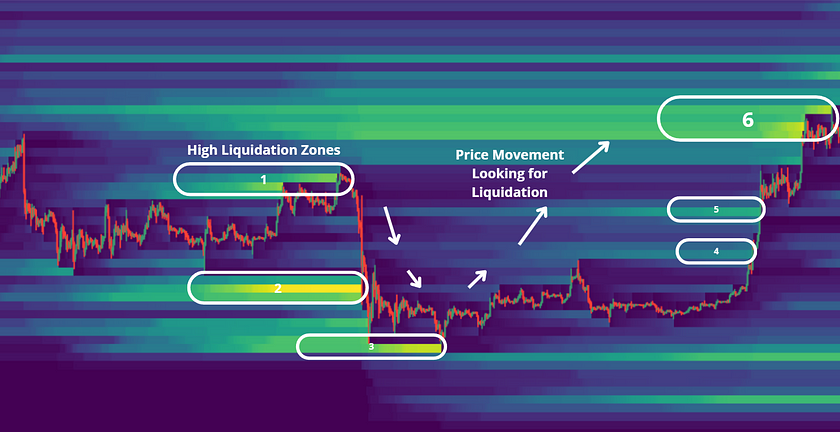

In this strategy, we utilize Liquidation Heatmaps, which offer valuable insights into potential price movements.

A key concept is Magnetic Zones, where clusters of liquidation levels at specific price ranges can attract price action.

Additionally, heatmaps highlight Support and Resistance Zones. These high-liquidity areas allow large traders, or “whales,” to execute orders quickly at favourable prices, often leading to price reversals once their trades are completed.

Lastly, liquidation levels can exert significant pressure on either the buy or sell side, further contributing to potential price reversals.

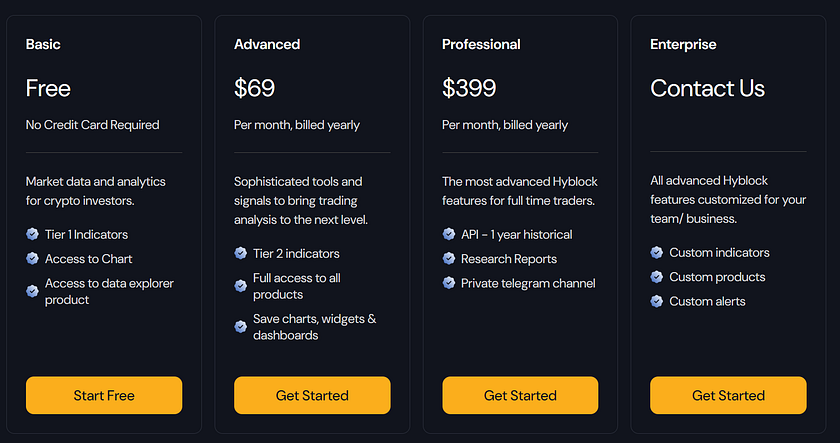

Subscriptions:

Note: This platform requires an Advanced Subscription to access the Liquidition Heatmaps. As an alternative, you can use CoinGlass, which offers similar tools for tracking market data.

Leave a Reply