What is Toki Finance?

Toki Finance is a pioneering cross-chain bridge protocol that leverages the Inter-Blockchain Communication (IBC) protocol to facilitate seamless, secure, and efficient interoperability between diverse blockchain ecosystems. By enabling native token transfers across networks such as Ethereum, BNB Chain, and various Cosmos SDK chains, Toki eliminates the need for wrapped tokens, enhancing user experience and reducing complexity.

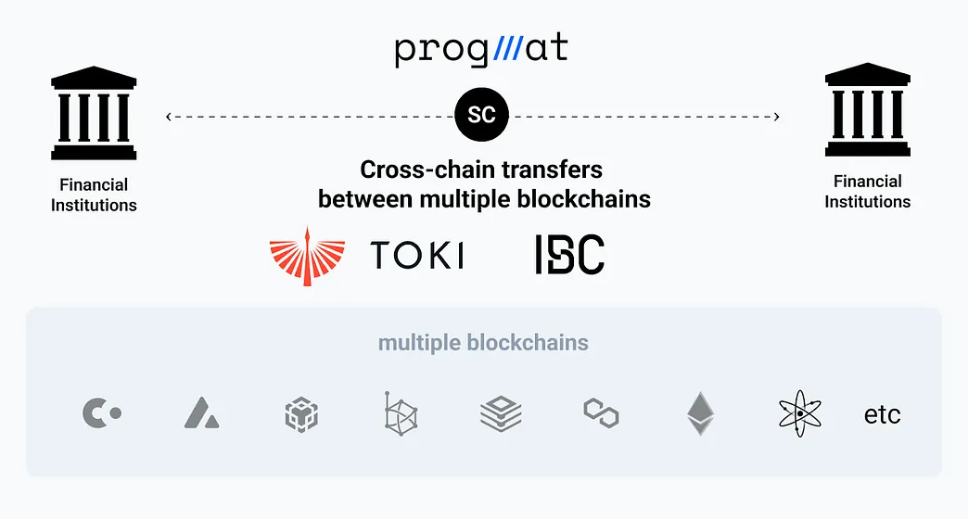

Beyond its technical innovations, Toki Finance is also building bridges between Web2 institutions and the Web3 world. By partnering with major Japanese banks—including MUFG, SMBC, and Mizuho. Toki is helping traditional finance tap into blockchain infrastructure in a compliant, forward-looking way. These partnerships, built through the Progmat platform, support the issuance and cross-chain movement of regulated, yen-pegged stablecoins on public chains like Ethereum, BNB Chain, and Cosmos. This opens the door to real-world financial assets flowing securely and natively across Web3 moving us closer to true mainstream adoption.

Recent Developments

In early 2025, Toki successfully launched its “β Mainnet,” establishing the first IBC connection between Ethereum and BNB Chain. This milestone enables users to perform one-click native token swaps between these networks, marking a significant advancement in cross-chain interoperability .

Looking ahead, Toki plans to expand its support to additional blockchains, including Optimism, Arbitrum, Polygon, and Solana, furthering its mission to create a truly interconnected blockchain ecosystem .

Technology Overview

Inter-Blockchain Communication (IBC) protocol

The Inter-Blockchain Communication (IBC) protocol is a secure standard that allows different blockchains to talk to each other—without needing centralized bridges or wrapped tokens. Instead of locking tokens on one chain and issuing synthetic versions elsewhere, IBC enables native tokens to move directly between chains using a combination of light client verification and modular messaging. You can think of it like sending a certified package through a secure, trustless courier: no middlemen, no replicas—just the real asset delivered safely across networks.

Toki Finance builds on this foundation by combining IBC with its own advanced bridging technology. When transferring between IBC-compatible chains (like those in the Cosmos ecosystem), Toki uses IBC’s native features to move tokens directly—no wrapping or recreating needed.

But when connecting to non-IBC chains like Ethereum or BNB Chain, Toki uses a secure lock-and-mint mechanism. Here, the original token is locked on the source chain, and a matching version is minted on the destination chain. What sets Toki apart is its trust-minimized approach: instead of relying on a central custodian, Toki verifies every transaction using a multi-prover security model—a combination of Trusted Execution Environments (TEEs), Zero-Knowledge Proofs (ZKPs), and Multi-Party Computation (MPC).

The result? A decentralized, secure, and scalable way to move assets across different blockchain ecosystems—without sacrificing trust or control.

Progmat

Building on its cross-chain infrastructure, Toki Finance integrates with traditional financial systems by supporting the issuance and transfer of regulated digital assets. Through its collaboration with MUFG, SMBC, and Mizuho, Toki participates in the Progmat platform, which facilitates the issuance of fully collateralized, fiat-backed stablecoins, initially denominated in Japanese yen (JPY). These stablecoins are minted on public blockchains, including Ethereum, BNB Chain, and Cosmos, after fiat reserves are deposited into trust accounts managed by MUFG Trust Bank.

The cross-chain transfer of these assets is achieved by locking stablecoins on the source chain and minting verifiable equivalents on the destination chain, leveraging Toki’s multi-prover security architecture (TEE + ZKP + MPC). The infrastructure also provides a scalable foundation for the future issuance and interoperability of tokenized securities, bonds, and other compliant on-chain financial instruments.

Toki vs Other Cross-Chain Bridges

While many cross-chain solutions exist such as LayerZero, Wormhole, and Axelar. Toki Finance takes a fundamentally different approach to interoperability*. These existing platforms have introduced clever architectures, like LayerZero’s modular messaging layer or Axelar’s general message passing, which enable smart contracts on different blockchains to interact. However, they often rely on external validator sets, oracle networks, or ultra-light nodes to verify cross-chain transactions.

For example, LayerZero uses a messaging protocol where data is relayed by independent relayers and oracles, which introduces a degree of trust in third-party actors. While this provides flexibility, it also creates potential security risks and centralization points if those external actors are compromised. In contrast, Toki eliminates this dependency

* “Interoperability is the ability for different blockchains to communicate and share data or assets with each other in a secure and seamless way. Right now, many blockchains (like Ethereum, Solana, and Cosmos) operate like isolated islands—they have their own ecosystems, rules, and tokens.”

Roadmap

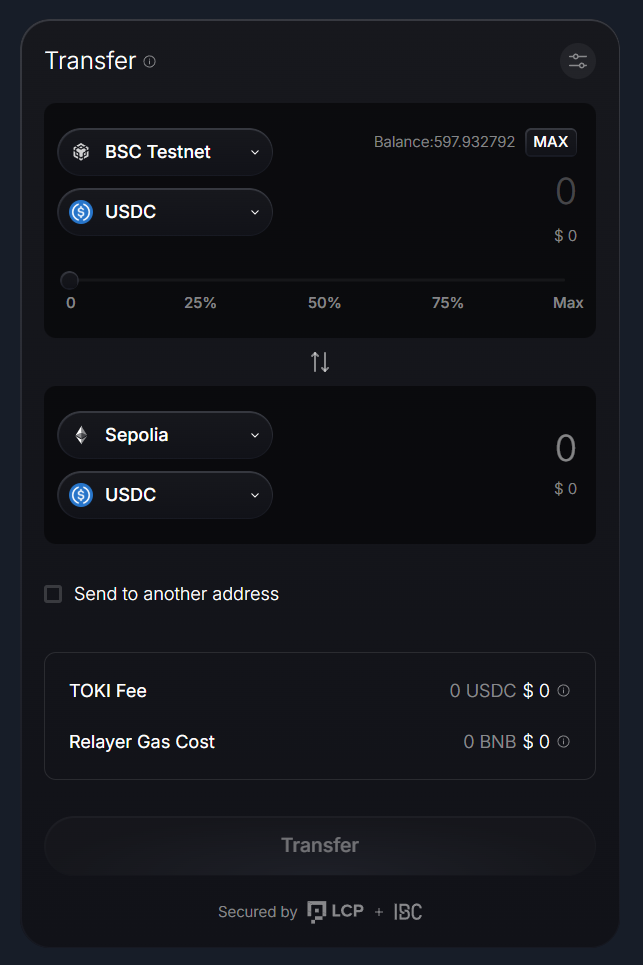

Testnet

The Toki Finance testnet is currently live and open to the public, giving users a chance to explore the protocol and understand how it works before the official launch and token generation event (TGE). It’s a hands-on opportunity to interact with the bridge, test cross-chain transfers, and see how Toki’s architecture handles interoperability across IBC and non-IBC chains.

For anyone curious about the tech—or looking to get involved early—the testnet is the perfect playground to learn, experiment, and get familiar without putting real assets at risk.

Link: https://testnet.toki.finance

β Mainnet

In February 2025, Toki Finance launched its Beta Mainnet, marking a significant milestone in cross-chain interoperability. This release enables users to seamlessly swap assets between Ethereum and BNB Chain using the Inter-Blockchain Communication (IBC) protocol

The Beta Mainnet also introduces Toki’s innovative features, including single-sided unified liquidity pools and a multi-prover security model that combines Trusted Execution Environments (TEEs) and Zero-Knowledge Proofs (ZKPs). These advancements lay the groundwork for a more interconnected and secure blockchain ecosystem. Engaging with the platform during this phase not only provides valuable feedback for ongoing development but also offers opportunities to earn rewards through the Toki Point Program, which recognizes early contributors and active participants. (Info: Cosmos Ecosystem Blog)

Point Program

To incentivize early adopters and community engagement, Toki Finance has launched the Toki Point Program alongside its Beta Mainnet. This initiative rewards users for interacting with the protocol—whether that’s bridging assets, providing liquidity, testing features, or helping spread awareness.

Participants can earn points by completing specific on-chain and social tasks. These points won’t just be for bragging rights—they’re expected to play a role in future token allocations, ecosystem rewards, or governance participation once Toki’s native token officially launches.

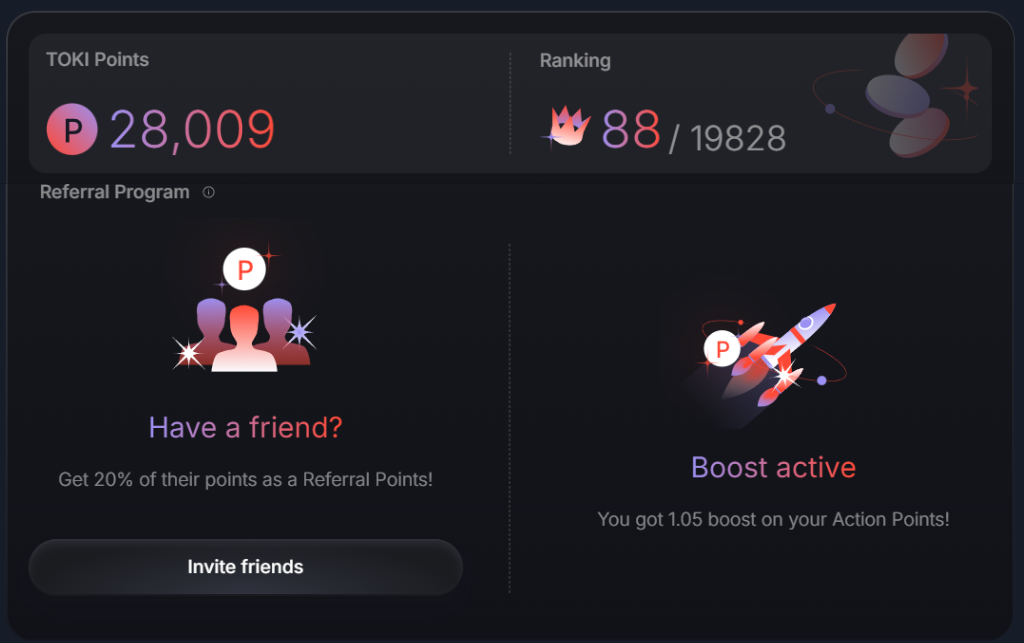

Point Program rewards users through three distinct types of points, each designed to reflect different kinds of contributions to the ecosystem:

Action Points

Transfer Points are awarded based on your token transfer volume. As you conduct more transactions over time, you can earn a Transfer Boost that increases your point earnings.

Loyalty Points

Loyalty Points reward your long-term engagement and contributions to the protocol through three different categories; Testnet Points (reward given to users participating in the protocol’s testnet phase) and Role Points (Discord).

Referral Points

Earned when users you’ve referred (via your unique invite link) complete activities and earn Action Points.

Note: Once you’ve interacted with the platform—by making just three transactions or providing liquidity—you can activate your referral code and start inviting others. You’ll earn 20% of the TOKI Points generated by your top 5 most active invitees each week (excluding their own referrals), with points tallied on Tuesdays and added to your Loyalty Points every Wednesday. Invitees also benefit with a 1.05x boost on their point earnings, making it a win-win for growing the Toki community.

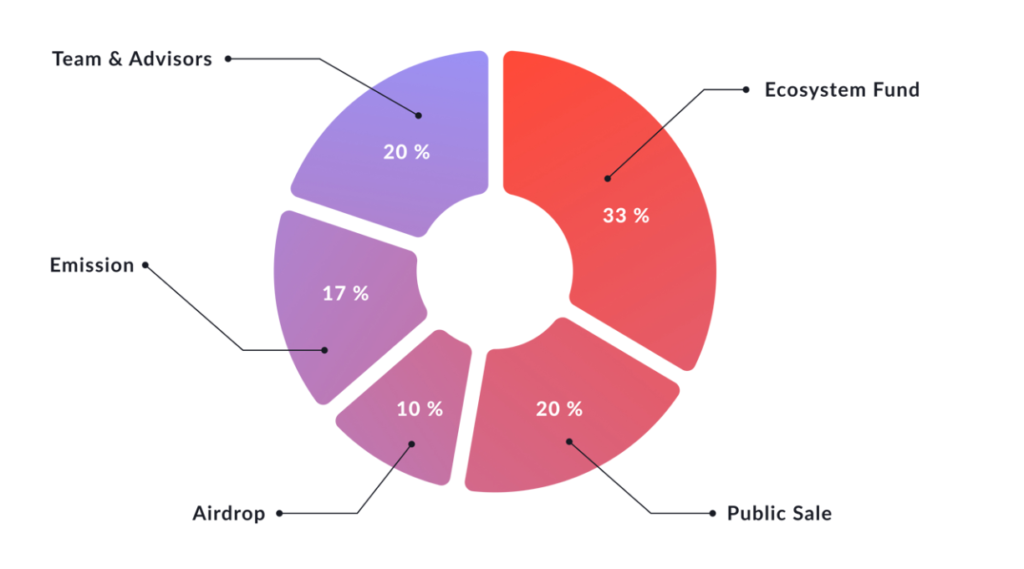

Mainnet and TGE

Toki Finance is advancing its vision of a fully interoperable, decentralized financial ecosystem. Following the successful launch of its Beta Mainnet in February 2025, which enabled seamless asset transfers between Ethereum and BNB Chain using the Inter-Blockchain Communication (IBC) protocol, Toki is now preparing for its Token Generation Event (TGE) scheduled for Q2 2025. The TGE will introduce Toki’s native token, designed to play a central role in governance, staking, and incentivizing liquidity providers. Notably, Toki has adopted a no-VC approach, ensuring fair token distribution that prioritizes community participation and avoids the selling pressures often associated with venture capital-backed projects. This strategy aims to foster authentic community governance and sustainable growth, aligning with Toki’s commitment to building a secure and efficient cross-chain infrastructure. (Info: docs.toki.finance)

As a core infrastructure player in the cross-chain space, Toki Finance has built strong connections across leading blockchain ecosystems. By integrating with the Cosmos network, it taps into the power of IBC to enable frictionless communication between sovereign chains.

Looking ahead, it may play a key role in upcoming stablecoin initiatives and cross-chain infrastructure aligned with major industry players. With Binance Japan actively working alongside MUFG’s Progmat platform to issue regulated stablecoins like JPY, USD, and EUR by late 2024, there’s a natural synergy with Toki’s mission to enable secure, compliant cross-chain movement of financial assets. While no formal partnership with Binance has been announced yet, Toki’s position as a core IBC bridge and its collaboration with Progmat hint at a potential future alignment. Especially as Binance continues to expand its presence in Japan and other ecosystems.

Community

Like every Web3 project, the community naturally gathers on platforms like Discord—and Toki is no different. From sharing feedback to helping new users bridge assets or understand IBC, the Toki Discord has become a hub for builders, explorers, and early supporters.

Toki Community Guide Link: https://tokifinance.notion.site/toki-community

Inside the Toki Discord, there are four main pillars that keep the community active and engaged:

- Roles – As users participate in the ecosystem, they unlock special roles based on activity, contributions, or referral milestones. These roles give recognition, access to gated channels, and sometimes even sneak peeks at future updates.

- Events – Whether it’s a challenge, meme contest, or points-based campaign, events help keep the energy high and offer fun ways to earn and connect with others in the ecosystem.

- AMAs – Regular Ask Me Anything sessions with the Toki team, partners, and ecosystem contributors give the community direct access to key insights and upcoming features. It’s a space where transparency meets real-time feedback.

- Community Chats – These open channels are the heart of Toki’s culture. From tech talk to cross-chain theories, you’ll find builders, learners, and bridge nerds all sharing ideas and growing together.

Roles

There are five main community roles you can earn by engaging in the ecosystem: Junior, Advanced, Expert, Senior Expert, and Principal. Each level reflects your growing involvement and impact in the Toki project. For content creators, there are also two special roles: Creator and Senior Creator, rewarding those who help spread the word through videos, threads, blogs, or other creative efforts.

Earning a role isn’t random—you’ll need to meet specific requirements and submit an application through the official Toki Discord Role Program. It’s a fun way to grow alongside the project and get recognized for your support.

AMA

AMAs (Ask Me Anything) are a big part of how Toki stays transparent and connected with the community. These sessions are where the team shares updates, explains recent changes, and sometimes brings in special guests from the Web3 space to add insight. There are two types of AMA seasons: the weekly recap sessions, which focus on announcements and quick updates, and the monthly AMAs, which go much deeper. During the monthly sessions, Toki reveals major developments, announces event winners (with real money prizes), highlights key community contributors who earned new roles, and releases the Monthly Letter—a written recap of everything important that happened. This letter invites the community to review and share feedback, making sure everyone stays involved in shaping Toki’s direction.

Monthly Letters from the Founder Link: https://tokifinance.notion.site/community-data-room

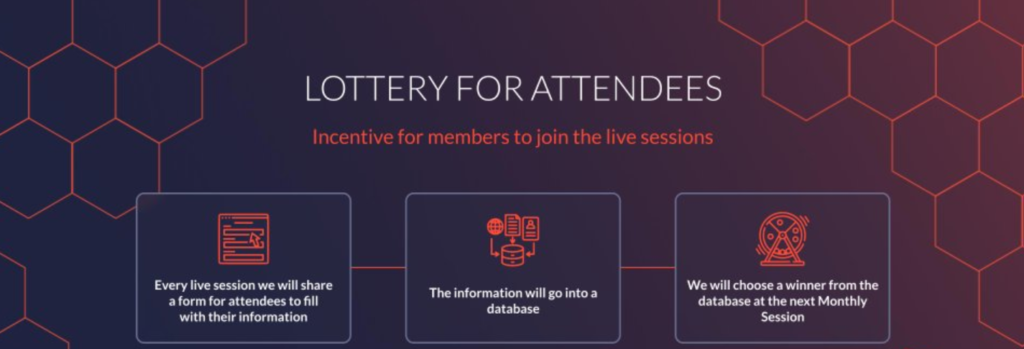

Plus, to make things even more exciting, every AMA includes a community lottery, where attendees have a chance to win loyalty points just for showing up and participating.

The rules are simple: Every time you join a weekly AMA and participate in the lottery, you earn an entry. These entries also count toward the monthly lottery, so the more you show up, the better your chances. During the AMA, a form is shared where you drop your Discord handle and a quick comment to confirm you’re tuned in. When it’s time to pick the winner, you must be present live, if your name’s called and you’re not there, another winner gets chosen. It’s an easy way to earn loyalty points just by staying involved and showing up.

Finance

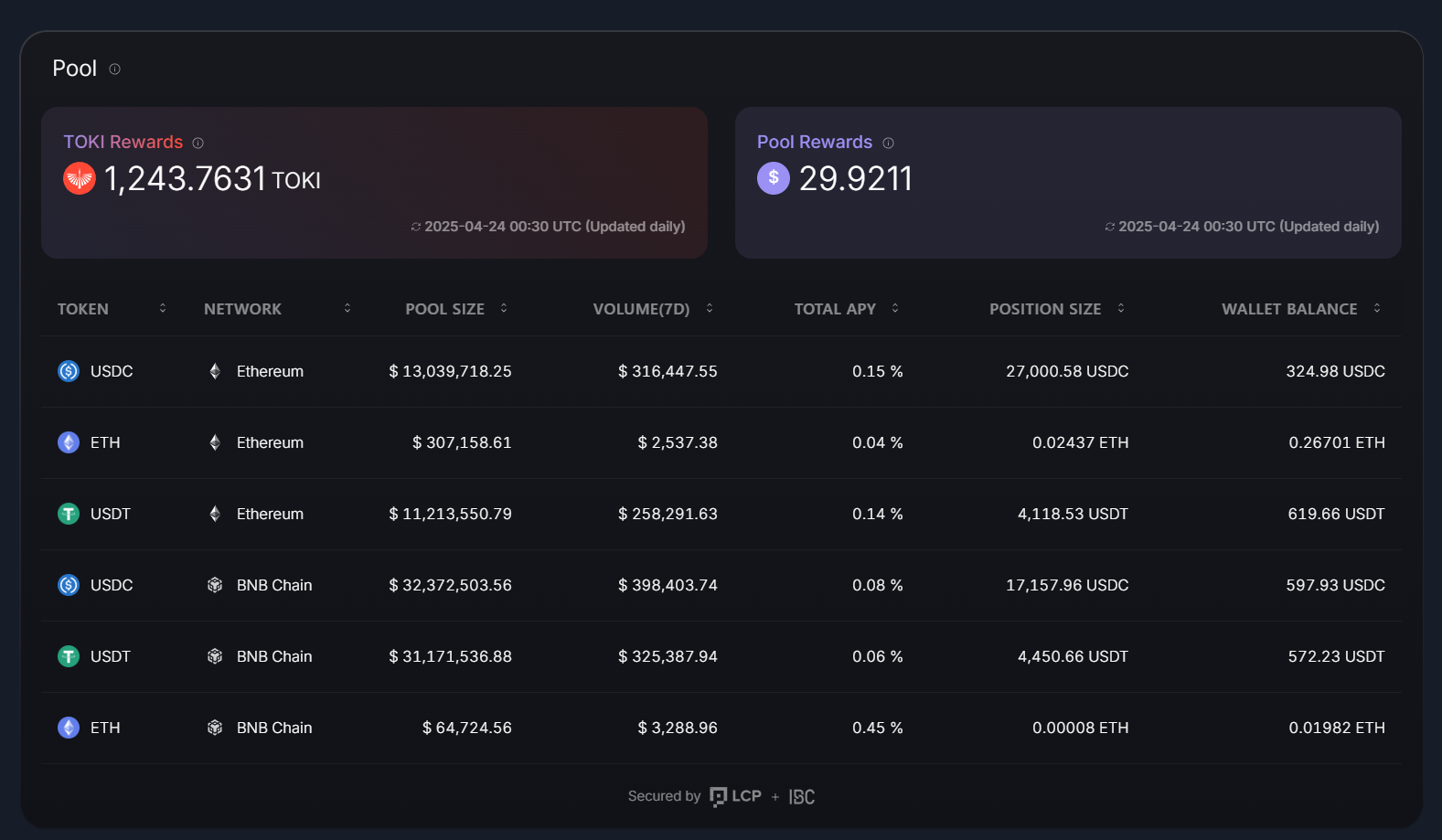

APR and Yield Dynamics in Toki

Toki Finance uses APR (Annual Percentage Rate) to reward users who contribute to liquidity and cross-chain activity. APR represents the yearly return you can earn by participating in Toki’s ecosystem, typically through liquidity provision or staking (when live). Unlike fixed rewards, Toki’s APR adjusts dynamically based on real-time usage and liquidity demand, ensuring that incentives remain fair and aligned with the protocol’s growth. This system encourages active participation while maintaining sustainable tokenomics.

How Transfers Drive Liquidity and Boost APR

Every cross-chain transfer made through Toki doesn’t just move tokens—it strengthens the network. When users bridge assets, they contribute to on-chain liquidity pools managed by Toki. The more transactions that flow through the bridge, the deeper and healthier those pools become, which in turn supports higher APRs for liquidity providers. It’s a virtuous cycle: constant activity increases volume, which boosts rewards, which attracts more users—driving adoption and stability across the ecosystem.

Staking in the Toki Ecosystem

As Toki moves toward mainnet, staking will become a key part of the platform. Users will be able to lock up their $TOKI tokens to support the network and, in return, earn staking rewards based on participation and duration. Staking not only provides passive income opportunities but also enhances decentralization and strengthens the protocol’s security.

Conclusion

In the end, Toki is more than just a bridge—it’s a unified platform where users can stake their assets, earn rewards and move tokens across chains, all from one secure, seamless interface. By combining interoperability with strong yield mechanics and a trustless bridging model, Toki offers a complete solution for those looking to stay liquid, stay safe, and stay connected across the Web3 ecosystem. Everything happens in one place—no wrappers, no middlemen, just real ownership on every chain.

Ty For Reeding!

Leave a Reply