“Can Trading Bots Really Compete? The Reality Behind AI’s Limitations in Trading”

What Are Trading Bots?

Trading bots are automated software programs designed to execute trades on behalf of investors and traders. These bots analyse market data, monitor price movements, and execute trades based on predefined algorithms and trading strategies. By utilizing advanced technology, trading bots can operate 24/7, allowing traders to capitalize on market opportunities even when they are not actively monitoring their investments.

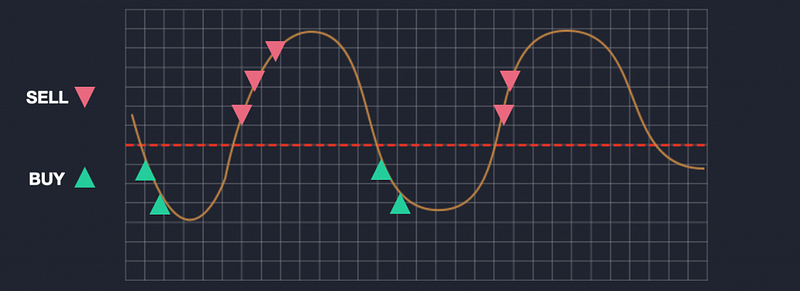

At first glance, it might seem simple for a bot to trade by merely buying low and selling high. However, the reality is much more complex. Current trading bots analyse data in two primary ways: through chart analysis and by utilizing real-time information.

Bots that rely on chart analysis interpret market trends using technical indicators, which can include support and resistance levels, trend lines, and various chart patterns. These strategies often employ a grid system, where the bot places multiple buy or sell orders at predetermined intervals, allowing it to take advantage of price fluctuations within a set range. Grid bots are commonly used on cryptocurrency exchanges like KuCoin, Binance, and others, where market volatility can create numerous trading opportunities for the bot to execute a trade.

On the other hand, bots that utilize real-time information can respond to news events and market sentiment. For instance, they may predict that a particular asset will rise if positive news is released and sell when negative news emerges. This capability allows these bots to make informed trading decisions based on the latest developments in the market, ultimately enhancing their effectiveness in navigating the complexities of trading.

Are Trading Bots Reliable?

The question of whether trading bots are reliable is indeed a significant one. In my opinion, they can be profitable, but this often requires access to extensive information and data. Typically, free bots and homemade bots created using tools like ChatGPT or developed by individuals with limited experience may not be sufficient for navigating today’s complex markets.

The financial market is a conglomerate of millions of minds making decisions simultaneously, each employing different strategies. Trying to use a bot to comprehend this intricate landscape can be challenging, especially with the current capabilities of AI. Moreover, due to the nature of these bots, they tend to operate effectively in short time frames or within specific trading ranges, often capitalizing small capital for long-term success.

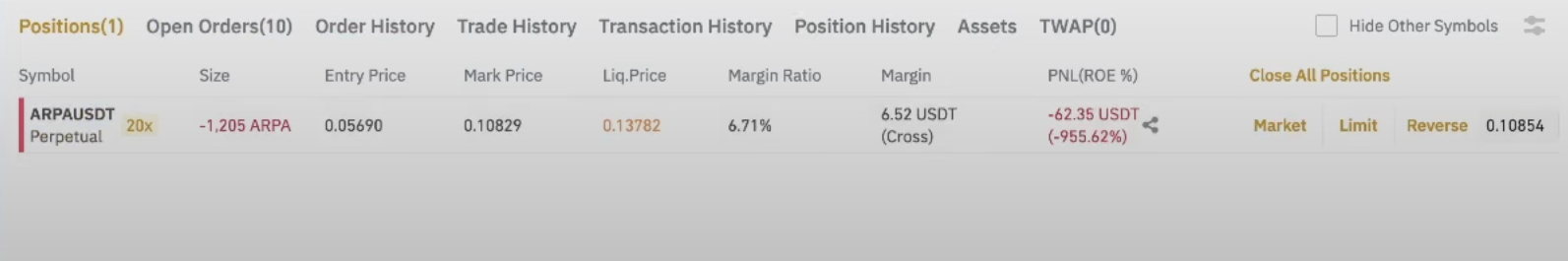

Grid Bot from Binance

On Binance, users have the option to copy successful grid trading bots based on recent performance metrics. For instance, one bot that had been active for nearly 24 hours showed a promising 29% yield on its allocated funds. With a minimum investment threshold of $100.

Grid trading bots operate within specified price ranges; in this case, the chosen range was between 0.058 and 0.044, meaning trades were only executed within these boundaries. Additionally, the bot was set to operate with a bearish trend, reflecting the broader bearish sentiment around Bitcoin at the time. Within a few days, the bot performed efficiently, securing returns of around 20% by operating consistently within the defined range.

However, market volatility quickly impacted this performance. While Bitcoin’s price declined, ARPA, crypto asset used, experienced a sudden and significant surge of 91%, a move typical of the crypto market’s inherent unpredictability. At this point, since I haven’t been liquidated, the open orders remain active, effectively locking in the losses. This leaves two options: either accept the current losses or wait and hope for the price to return to the chosen range.

Free Trading Bot — “Dark Venus”

One of the best free trading bots available is Dark Venus, which is built around the use of Bollinger Bands. Bollinger Bands are a popular technical analysis tool that consists of a moving average line and two price channels (or “bands”) above and below it. These bands expand and contract based on market volatility, helping traders identify potential buy and sell signals by showing when an asset may be overbought or oversold.

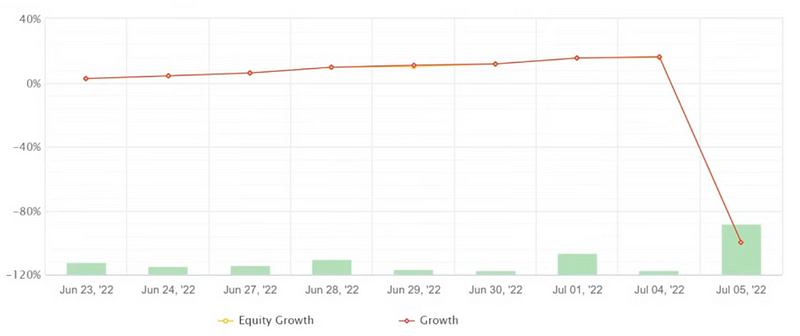

This is a typical scalping bot, which seeks to make small profits on numerous trades within short timeframes. The strategy can be effective during consolidation phases, such as the “accumulation” or “Power of 3” phases, where the price remains within a relatively tight range. During these periods, the bot is able to capture small price movements, generating consistent gains.

However, the limitations of Dark Venus become apparent when the market enters a trending phase, especially during a strong downtrend. In such conditions, prices start moving decisively downward, creating an environment where the bot’s scalping strategy is no longer effective. Instead of recognizing the shift and adjusting to the sustained downward movement, Dark Venus continues to operate as if the market were still stable and range-bound.

As the downtrend persists, the bot likely continues placing buy orders, expecting brief rebounds or reversals that fail to occur. This leads to significant losses as the market consistently moves against its positions.

Dark Venus, along with other bots, is available on MQL5 — a specialized platform that uses an integrated programming language to develop indicators and trading strategies. MQL5 is designed for MetaTrader 5, a free online trading platform.

Conclusion

While trading bots are not advanced AI engines capable of fully understanding real-world market dynamics, they simply analyze vast amounts of data provided by users. As a result, making significant profits with these systems remains challenging. The notion that one can set a bot to trade for a few days and return to find gains is still largely a misconception.

It’s crucial to recognize that these mechanisms require ongoing monitoring and adjustments throughout the trading process. For beginners in trading, it’s important to remember that using trading bots can be just another avenue to lose your investment. Stay informed!

Recommended Related Video

Description:

In this video, 3 stock trading bots where created with $10,000 to see if its profitable.

The first bot uses a mix of momentum trading and value investing on a set of “safe” stocks.

The second bot scans news articles for company mentions. If the news is good, it buys the stock. If bad news comes out about a stock it owns, it sells right away.

The third bot randomly selects a stock, finds related news articles, and uses AI to match them with Taylor Swift lyrics to gauge sentiment. If the lyrics are happy, it buys the stock. When negative lyrics come up, it sells.

Leave a Reply