“Discover how wallet copy trading works, how to identify a reliable wallet, and the steps to start trading effectively.”

Basics

Wallet copy trading is an innovative type of trading that allows users to track the activity of other wallets on a blockchain and replicate their trades. This approach can help traders learn from experienced participants, mimic successful strategies, and potentially achieve similar profits.

On the Solana network, wallet copy trading has gained popularity with the help of specialized Telegram bots designed for this purpose. These bots are built to operate seamlessly within the Solana blockchain, making it easy for users to get started. When you use one of these bots, it creates a dedicated wallet for you on the Solana network, simplifying the setup process. Instead of manually managing the technicalities of creating and maintaining a wallet, you only need to fund the bot-generated wallet with SOL, Solana’s native cryptocurrency.

This automated system eliminates much of the complexity for users, allowing them to focus on monitoring and copying the strategies of other wallets. However, one of the risks to consider is the potential downside of copying another wallet’s trades. If the wallet you’re tracking makes poor trading decisions or experiences significant losses, you will also be replicating those bad trades, putting your assets at risk. Additionally, there’s always the chance that the wallet you’re copying could lose all its assets due to unforeseen circumstances or high-risk moves.

Wallet Hunting

To hunt a good wallet for copy trading, it’s essential to evaluate specific characteristics to ensure it aligns with your goals. Key metrics to look for include the wallet’s win rate, ROI (Return on Investment), and PnL (Profit and Loss). These indicators help you determine the wallet’s overall performance and reliability.

For example, if a wallet frequently makes multiple purchases of the same coin in quick succession, it’s likely engaging in strategies like sniping or scalping. Sniping involves making ultra-fast trades to capitalize on small price movements immediately after a token launch or major announcement. Scalping, on the other hand, focuses on profiting from rapid, short-term price fluctuations.

Key metrics:

Win rate: +50%

ROI: 80%

PNL: +10 SOL

Avoid frequent airdrops

Avoid multiple buys per token

Avoid snipers and scalpers (trades every 1min)

To find wallets with promising trading strategies, several platforms offer the tools and data needed to identify and analyse them effectively.

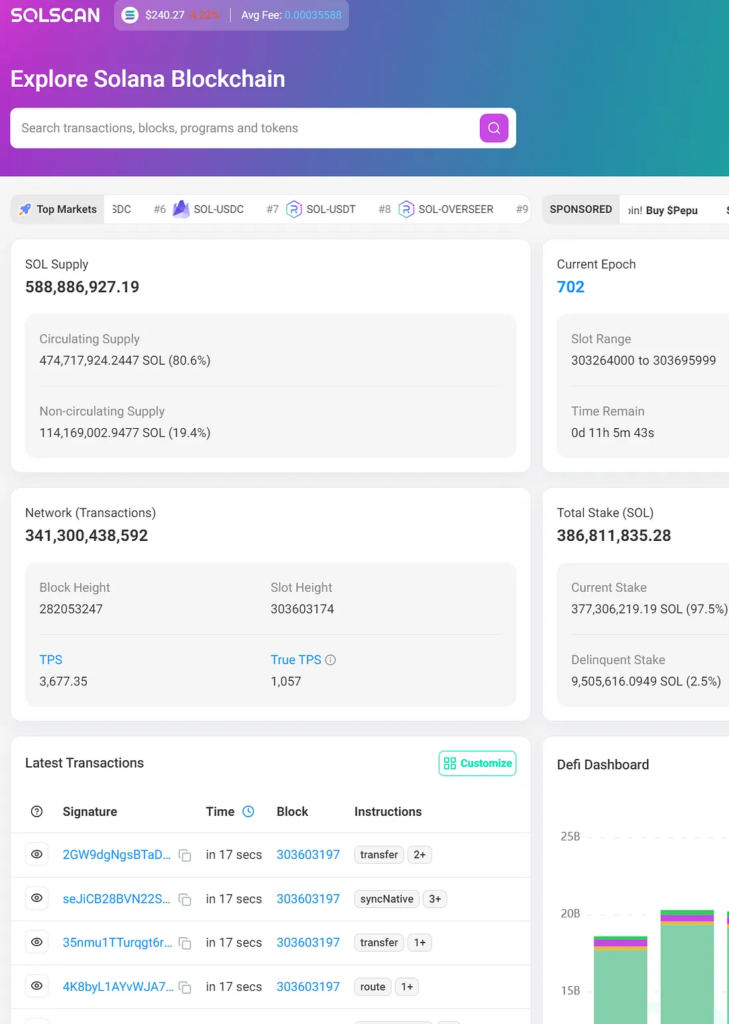

- Solscan, for instance, is a blockchain explorer tailored to the Solana network. It enables users to track wallet activity, review transaction histories, and monitor token movements.

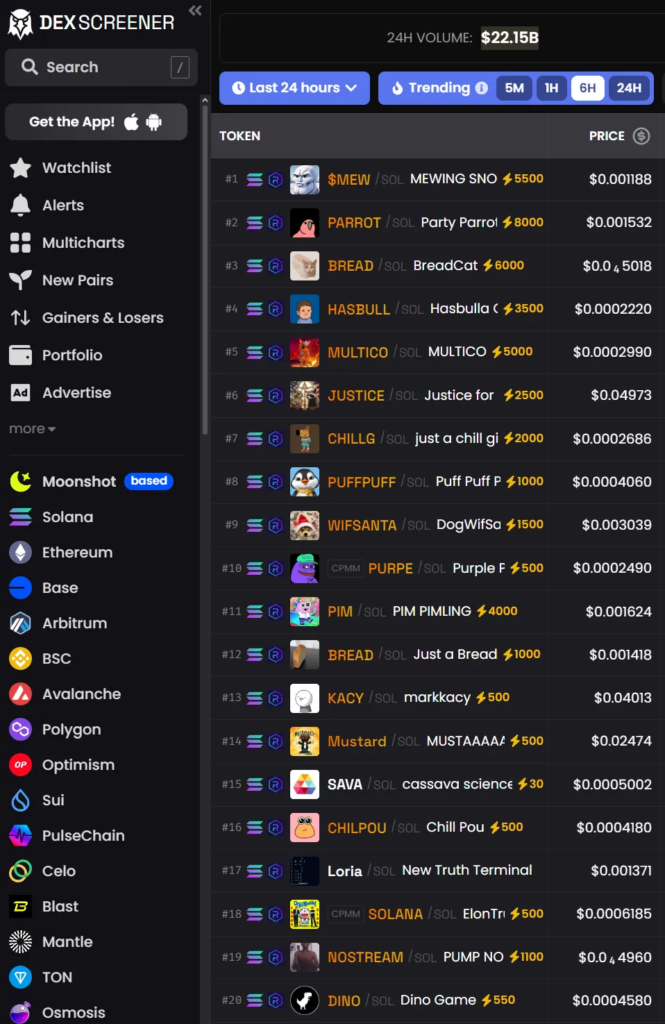

- DEX Screener, which specializes in monitoring decentralized exchange (DEX) activity across various blockchains. It provides real-time data on trades, volume, and price trends, helping users pinpoint active wallets making strategic moves.

- GmGn can provide curated lists or community-driven insights into high-performing wallets. By leveraging these tools, traders can gather actionable intelligence to enhance their copy trading strategies and identify wallets worth following.

Find Wallet:

Solscan

DEX Screener

GmGn

Degen Wallet Checker (30$ month)

Tip

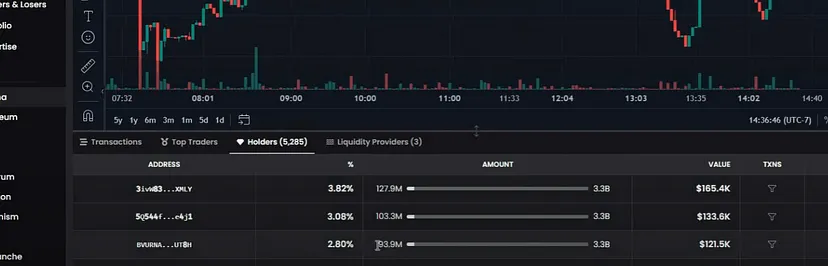

For example, if you’re following a YouTuber or a person of interest and you know how much of a certain token they hold, you can go to DEX Screener. In the token’s section, search the “Holders” list to try and match the amount held by that person.

Additionally, you can check the wallet you’ve chosen on Zerion, which will show you all the assets contained within that wallet, giving you a clearer picture of its holdings and activity.

Trading Bots

The trading bots are automated tools that operate through Telegram. These bots allow users to connect with them via Telegram channels, where they can execute trades on their behalf. Once connected, users can fund their wallets, and the bot will automatically replicate trades based on real-time data.

Telegram Bots:

To use a trading bot effectively, let’s take Tradewiz as an example, known for being one of the fastest options available. But, if you prefer a smoother and more user-friendly experience, you might want to try Trojan, which features simpler commands and an intuitive interface.

First, fund your account with SOL. The wallet address will appear directly in the chat, making it easy to transfer the required amount.

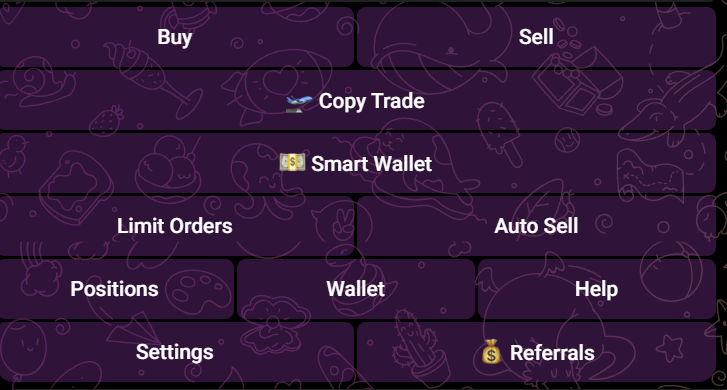

Once you’ve identified the wallet you want to copy, navigate to the “Copy Trade” button within the bot’s menu. Press “Add+”, and a new message will appear, allowing you to configure the settings for your trades. These settings include crucial parameters such as target wallet, trade size, slippage... Each setting plays a vital role in determining how the bot executes trades, so it’s essential to review them carefully.

➡️ TradeWiz Docs ⬅️

Some parameters you can use to get start:

Buy Percentage: 100%

Max and Min Buy: 0.025 SOL

Slippage: 40%

Total Investment: 0.1 SOL

Gas Fee: 0.005 SOL

Each Token Buy Times: 1

Unburned: Don’t buy

Advise

Copy trading bots often experience slight delays in replicating trades. If the wallet you’re copying sells off its holdings quickly, your bot might still be in the process of completing the last buy order. This lag can result in the bot buying at a higher price and potentially incurring losses when the market moves against the trade.

In this example, we can observe that the bot executed the buy transaction simultaneously with the wallet. However, it only completed the sell transaction nearly 30 minutes later.

Stay vigilant, monitor your trades regularly, and never invest more than you can afford to lose. Trading coins on the Solana network often involves high volatility, so it’s crucial to approach with caution. To mitigate this risk, try to focus on long-term wallets with a proven track record of consistent and strategic trading, rather than those engaging in high-frequency or short-term trades.

Leave a Reply